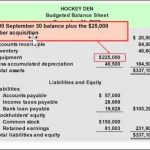

No, a chart of accounts and a balance sheet are not the same thing. A chart of accounts has accounts from the balance sheet and income statement and feeds into both of these accounts. Income is often the category that business owners underutilize the most. Some of the most common types of revenue or income accounts include sales, rental, and dividend income.

© 2024 Intuit Inc. All rights reserved

For example, you might want to create separate accounts for fuel expenses, truck maintenance, and insurance. First, if they’re not already set up, create expense accounts specifically for IFTA fuel. When entering bills for IFTA fuel, enter the gallons as a number in the memo area of the bill. Be sure to enter only the gallons in the memo area, without any additional wording, to allow for the calculation on the report. By using QuickBooks, you can save time and reduce the stress of managing your trucking company’s finances. You’ll have a clear picture of your income and expenses, and you’ll be able to generate reports and track your mileage easily.

How to Dispatch Trucks from Home

See articles customized for your product and join our large community of QuickBooks users. Identifying which locations, events, items, or services bring in the most cash flow is key to better financial management. Use that information to allocate resources to more profitable parts of your business and cuts costs in areas that are lagging. The chart of accounts streamlines various asset accounts by organizing them into cost estimation methods line items so that you can track multiple components easily.

Learn about the chart of accounts in QuickBooks Online

- The accounts are organized in columns by name, account type, detail type, balance in QuickBooks, and bank balance.

- You’ll have a clear picture of your income and expenses, and you’ll be able to generate reports and track your mileage easily.

- Assign customer invoices for hauls using that unit, along with any bills for expenses directly relating to that specific unit, to the unit’s class in the transaction input screen.

All existing accounts will remain after you apply a template, including default accounts like Accounts Receivable (A/R) and Accounts Payable (A/P). Default accounts are also available in COA templates, but only add them to your template if you need a duplicate account. A template from scratch displays only the available account types with the name and details blank for you to fill in. If you want to comply with the standard format you needed for a report, you can export the report to Excel. You can save this customized report by clicking Save customization. Then, go to the Custom reports tab when you need to pull up this report in the future.

Get Started

This helps you categorize transactions and set up the chart of accounts correctly to make sure your books are accurate. One of the unique features of QuickBooks is its ability to track your mileage. As a trucking company, this can be especially useful, as you need to keep track of the miles your trucks travel for tax creditor definition purposes. QuickBooks allows you to track your mileage automatically using your smartphone’s GPS, or you can manually enter your mileage.

Look at the account type in your chart of accounts to determine this. QuickBooks automatically sets up your chart of accounts, but you can customize it to meet your business needs. You can add or remove accounts, and make them active or inactive. You can also use account numbers any time, it is not required but your accountant may recommend them. The chart of accounts is a list of all the accounts that QuickBooks uses to track your financial data. Each account keeps track of your transactions and shows your balances.

As your business grows, so will your need for accurate, fast, and legible reporting. Your chart of accounts helps you understand the past and look toward the future. A chart employment contracts for small businesses of accounts should keep your business accounting error-free and straightforward.

To format a report, you can modify it using the customize feature and save it for future use. Hello, we are a multi-member LLC (trucking company) and I want to make sure our initial setup is correct. We will haul a load for a customer from Point A to Point B and then receive payment. The pre-made product and service-based templates will be set up for you to apply or modify.