Posts

You’ll find nothing out of your reach with cellular phone charging you—including, you could financing the real time local casino play. Loan providers processes mobile money on the blink of an eye. This is going to make great post to read cellular checkout as fast as credit cards transaction—or even shorter. When you accept mobile costs, you get rid of friction and you will traps to suit your customers. This category, also known as meters-trade, means any kind of exchange you to definitely makes to the a smart phone.

Great post to read: A knowledgeable family members plan complete

Inside the elements of the newest development community, although not, Texting payments is actually prevalent and commonly trusted. Samsung Spend can only create internet money if you link an excellent Visa Checkout membership, nonetheless it works on the company’s cell phones and you will (really well) for the its smartwatches. Apple Shell out works on the Fruit Check out, because you you will expect, there are a handful of Bing Wear Operating-system watches one to help Google Pay.

Just what requirements must my personal mobile see allow cellular commission?

Users just who used its cellular phone otherwise NFC equipment to spend had been very likely to suggestion than just people just who used antique magstripe notes. Here are some other ways taking mobile payments support enterprises. It consolidation produces mobile payments the most much easier treatment for shell out. There’s zero being forced to see an atm to spend anyone back—you can do one because of the delivering an age-import using your bank’s app in your mobile phone. And there’s you should not dig in the wallet for your wallet from the checkout prevent—you can just tap your own cellular phone to spend. Particular borrowing from the bank and you can debit notes is actually enabled that have contactless NFC tech.

Most other Things & Services:

- BT ‘s the simply United kingdom driver so that payments by landline, providing to customers whom is generally of an adult age group and less likely to want to individual a mobile phone.

- If you are looking to possess a means to play on the brand new go, this service ensures a smooth fee feel providing you has a network laws.

- As there’s no actual contact involving the equipment and also the payments audience, mobile bag money usually are called contactless costs.

- RFID is absolutely nothing the fresh—it’s been used for many years to have things such as browsing items in food markets and you can baggage for the baggage states.

- Definitely read the conditions and terms of incentives prior to your try to claim her or him.

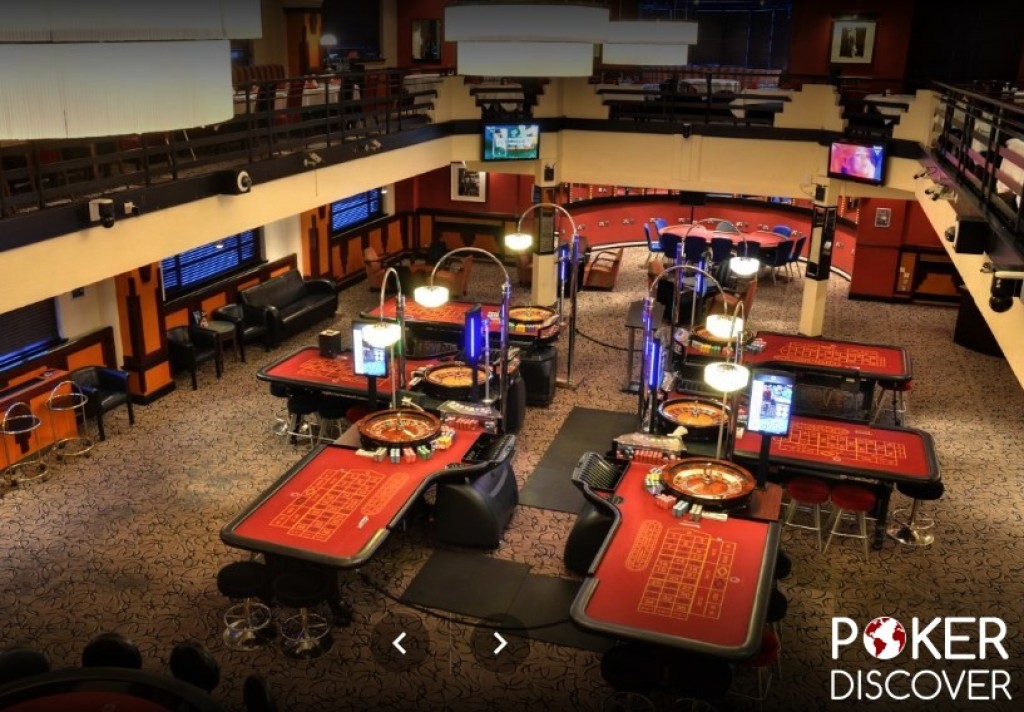

- The new popularity of cellular gambling enterprises enjoy is rising and you will so might there be now banking tips targeted at cellular profiles, such as shell out from the cellular phone alternatives.

To check on if your card is actually contactless-let, discover the newest revolution-such signal published for the side or straight back of one’s credit. To expend, keep the card along side costs reader if you don’t pay attention to a good beep. Google’s cellular handbag tech, Yahoo Pay, can be acquired to your all of the NFC-let gizmos that run Android adaptation cuatro.4 or later. To utilize Yahoo Spend, open the brand new application in your mobile phone (and that necessitates the member for a secure secure display) and you may finish the exchange because of the holding your equipment over the payments viewer. An educated cellular percentage applications give a way to pay to possess goods and services, and all by using little more than a software attached to your own smartphone.

All services, because they transmit charge card advice, need conform to the newest PCI Study Protection Standard (PCI DSS)—a comparable simple used with analogue payment notes. Filled with things such as implementing new transport security than simply SSL and you can very early TLS. Of several online stores have previously integrated Fruit Spend in their checkout procedure, and then make online purchases as well as simple. When you are shopping inside a physical store, unlock the fresh Wallet app, find the cards you’d wish to have fun with and hold your unlocked mobile phone along the Faucet to invest credit viewer. The newest software allow you to know while the exchange could have been completed. What’s going on within the a mobile purse transaction is the fact the equipment and also the NFC-permitted part away from selling is actually essentially speaking with one another.

During the $60, Cricket’s limitless analysis plan isn’t the most affordable alternative out there. However it is one of the few prepaid possibilities that have thorough advantages including a free Max streaming subscription, affect stores and spot analysis. Our favorite prepaid service package costs just $thirty-five a month after you enter for automatic money from the Verizon.

LevelUp, PayPal, Samsung Spend, and Google Spend try good of this type. Mobile repayments try tremendously well-known solution to take on in the-people repayments because they’lso are safer, punctual, and much easier. Indeed, around the world mobile spend volume is predicted to improve to help you $6 trillion from the 2024. Whether somebody is actually a rush or perhaps looking for a keen easy way to pay, using a phone to invest also provide an instant, safe, and you will much easier means to fix complete purchases away from home. The currency conversion spends the real middle-market rate of exchange – and only a decreased, transparent payment.

We see mobile billing casinos you to definitely charges virtually no costs when depositing money on their cell phone. You can read much more about any additional costs to the casino’s percentage page. For those who’re also searching for a detachment choice, try other best financial actions. Explore an elizabeth-purse such as Skrill if you wish to cash out earnings easily from the little to no cost, otherwise pick an electronic provider such as PayPal if you like limitless withdrawals. That’s where a new sequence away from amounts, named a good token, is made regarding you to-go out purchase. So it token goggles the bank card guidance and so the vendor will not assemble it as well as the whole purchase is intended to remain safer.